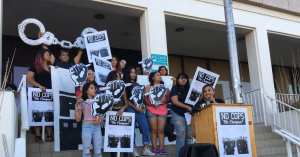

Four years ago, the Saint Paul Federation of Teachers (SPFT), along with parents and community members, committed ourselves to ensuring that students in Saint Paul, particularly students of color, receive a quality education.

While we’ve made great strides to improve public education in Saint Paul, there is much more that still needs to be done. Class sizes are still too big; there are not enough nurses, counselors or social workers; and we need to include more schools in programs that have proven effective in disrupting the school-to-prison pipeline, such as restorative practices and teacher home visits.

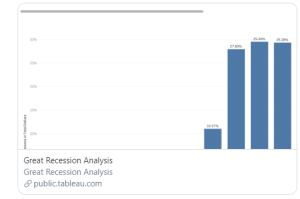

However, like many school districts across the country, the Saint Paul Public School system is financially broke. It’s become an annual tradition that they announce how big the deficit is and then make the needed cuts.

SPFT decided to do something different in our current negotiations. We are using our contract campaign to show that corporate philanthropy is not an adequate substitute for corporations paying their fair share of taxes for public education and that there are serious problems with the way corporations carry out their philanthropy for our schools.

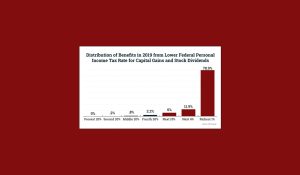

Our campaign is challenging the myth of scarcity. We have highlighted how changes in state law have resulted in Minnesota’s largest corporations paying lower state tax rates than they did previously and that many of those same corporations use loopholes and tax havens to pay even less taxes.

For instance, we calculated that UnitedHealth and US Bank avoid paying a total of $25 million a year in Minnesota state income taxes. Ecolab, the largest corporation based in St. Paul, is holding $2.1 billion in offshore accounts to avoid paying income taxes in the U.S.

School districts are so underfunded and desperate for money, that they have developed a kind of Stockholm syndrome, in which they honor and praise the very same corporations that are starving our schools by not paying their taxes. SPFT proposed that the St. Paul school district join us in seeking increased funding from these corporations, but the district instead issued public statements defending those corporations.

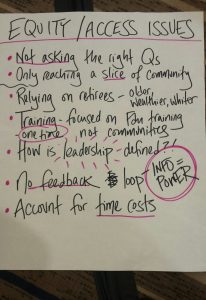

Charity is not a replacement for government. When we fund schools through taxes, we have democratically elected representatives who decide how to best spend those funds for the common good. In contrast, with charitable contributions, corporations decide what is best for our schools and dictate how to use their donations.

Corporate donors can – and often do – make applicants jump through numerous hoops to receive funding. For instance, contrary to NCRP’s Philanthropy at Its Best criteria, the Ecolab Foundation has burdensome application requirements for minimal grants. Ecolab Foundation gave $244,000 to the Saint Paul Public Schools last year through the company’s Visions for Learning grants, which require individual teachers to each fill out a five-page application for grants of about $2,000 to buy classroom equipment and materials.

Some corporate donors also tie their funding to consumer spending:

- Target gave the Saint Paul schools $124,000 through its now discontinued “Take Charge of Education” program, in which the company donated 1 percent of Redcard holders’ total purchases to a school of their choice. This means that customers who designated a specific school in Saint Paul made $12.4 million in Target purchases on their Target Redcards.

- General Mills donated $4,800 from its Box Tops for Education program, which rewards schools at a rate of 10 cents per box top. Saint Paul parents collected box tops from almost 50,000 General Mills products to earn this amount of money.

There is a clear imbalance of power between the school district and the corporations. The “power of the purse” has made the district grateful for corporate donations of any amount, regardless of how the funds are designated to be used. A true partnership in which the grantmaker and grantee are working towards the same goals would involve real conversations between the corporate donors and the district, along with teachers and parents, to identify the most pressing school needs and the best avenues for the corporate involvement.

The “power of the purse” is also responsible for the school district deliberately ignoring the leadership role that the district’s corporate donors play in opposing tax increases for public education. Ecolab CEO Doug Baker is on the Executive Committee and chairs the Fiscal Policy Committee of the Minnesota Business Partnership, which is made up of the CEOs from the state’s 100 largest employers.

Baker, who received $25 million in total compensation last year, led the Business Partnership’s opposition to an increase in the Minnesota state income tax rate for the wealthiest households. Despite their opposition, the legislature raised the top tax rate in 2013, which allowed the state to invest an additional $350 million a year for K-12 education.

Minnesota is a rich state. Our large corporations are making huge profits, while contributing less and less to the community. We need those corporations to pay their fair share so that all of our children can receive the education they deserve.

Nick Faber is president of the Saint Paul Federation of Teachers. Follow @SPFT28 on Twitter.