Adapted from The Oregon Community Foundation – Can it Build a Statewide Legacy of Equity and Inclusion?

Earlier this year, The Oregon Community Foundation (OCF) approved a $300,000, seven-year loan to support Albina Opportunities Corporation (AOC). AOC offers financing to small businesses owned by women, people of color, immigrants and persons with disabilities in Portland. Among the endeavors funded by AOC is Escuela Viva Community School, founded by Portland mother Angie Garcia for her own daughter. “I was looking for a program that would nurture her spirit and provide a bilingual environment. The truth is that I just couldn’t find it. So I started this.”

The demand for the school’s dual language programming became so great that by 2010, Escuela Viva required quick capital to set up a new center and consolidate its three locations. AOC’s former executive director, Terry Brandt, observed, “Not only does [Escuela Viva] provide children with a unique educational opportunity, but it has created and will sustain living wage rate jobs in our community.”

This type of impact investing can generate a measurable social or environmental impact alongside financial return by providing capital to companies, organizations and funds. Clara Miller, president of F.B. Heron Foundation, has written that 21st-century funders must “go beyond marginal and auxiliary philanthropy (the traditional and appropriate model for charity) to engage actively with the whole economy, positioning ourselves to be fully engaged for mission both inside the foundation and outside in the economy.”

Compared with other philanthropies, community foundations face special challenges in place-based impact investing due to their unique structures, limited discretionary dollars and donor mandates. NCRP’s foundation assessment initiative, Philamplify, recently explored how the Oregon Community Foundation (OCF) became a proactive leader in this space.

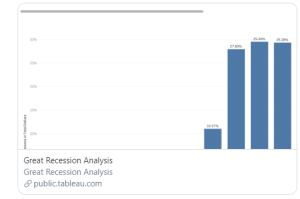

In 2013, Mission Investors Exchange profiled OCF for investing one-half of 1 percent of its $1.3 billion endowment, or approximately $6.5 million, in Oregon-based early-stage investment funds such as the Oregon Angel Fund. As the foundation’s endowment grows, so does the amount of investment in early stage growth companies and start-ups. OCF reported that the current total is roughly $8 million, of which $7 million has been deployed to date.

To strengthen the foundation’s capacity to meet its mission, including its strategic focus on economic vitality in Oregon, OCF launched an impact investment program in 2014. Among its efforts, the foundation has sponsored studies about Oregon’s capital ecosystem, and provided loans and grants to help develop a skilled workforce and build the state’s post-recession economy. The program uses discretionary grant money to make program-related investments (PRIs), including $3 million allotted by the foundation’s board several years ago. It will be fully deployed this year, and the board plans to discuss potential future allocations.

To help move capital to rural Oregon businesses, in 2014 OCF invested $1 million in Craft3, a regional nonprofit community-development financial institution (CDFI). Craft3 provides low-interest loans to entrepreneurs and small-business owners who are unable to access traditional credit, including EcoTrust, which used a $1.3 million short-term loan from Craft3 and a grant from OCF in 2014 to purchase and permanently protect a coastal estuary in Northern Oregon.

The community foundation also partnered with Meyer Memorial Trust, a leader in mission-related investing in Oregon and southwest Washington. OCF committed $2 million to the partnership to provide low-interest loans to Oregon nonprofits. Other support includes a loan to the Portland Seed Fund, a company accelerator that provides capital, mentoring and connections; and capacity building grants to AOC, the CDFI that helped Angie Garcia grow Escuela Viva.

The Democracy Collaborative featured OCF as one of 30 innovative community foundations from across the country for its work with AOC, Craft3 and Meyer.

Behind the scenes, OCF offers a Socially Responsive Investment Fund to its donors and nonprofit endowment partners to screen out investments inconsistent with their values and “invest in companies that have strong records in the areas of corporate governance, community relations, diversity and employee relations, energy and the environment, product quality and safety, and non-U.S. operations.”

In an interview for NCRP’s assessment, Elizabeth Carey, vice president and chief financial officer, shared that OCF is discussing avenues such as fossil fuel divestment, but sees an opportunity to do more with proxy votes and “activist investing.” She said: “One of our managers was invested in a Norway company that was actively considering whether to drill in tar sands, and invested so they could vote to block that. They brought up proxy votes to keep the company from going in that direction and blocked that. [If we divest], we don’t get a say in what companies do. We have had positive impacts for companies that would have made bad environmental decisions.”

OCF shows a clear commitment to economically vibrant communities across the state, and its strategic plan for 2015-2018 outlines a goal to continue this work and “allocate well-targeted impact investments, evaluating their outcomes and priority within OCF’s overall mission.” OCF can build on this commitment by dedicating more staff resources to the program, and increasing the proportion of its endowment allotted for impact investments, especially investments that advance its equity goals, like Escuela Viva.

Caitlin Duffy is senior associate for learning and engagement at the National Committee for Responsive Philanthropy (NCRP), and co-author of “Oregon Community Foundation – Can it Build a Statewide Legacy of Equity and Inclusion?” Follow @NCRP and @DuffyInDC on Twitter and join the #Philamplify conversation.

Images by Michael Silberstein, van Ort and Eli Duke. Modified under Creative Commons license.