Earlier this year, NCRP released a special edition of our quarterly journal dedicated to mission investing, or making investments that reflect an organization’s values. As foundations are only required to pay out 5 percent of their assets annually in grants and the administrative costs of making these grants, much of the remaining 95 percent is invested to strengthen the foundation’s economic viability. As such, mission investing can be just as important to creating change as grantmaking.

Many great groups promote investments that support both the economy and the greater good, such as Mission Investors Exchange, Confluence Philanthropy, The Forum for Sustainable and Responsible Investment (US SIF) and Divest-Invest Philanthropy, just to name a few.

Foundation leaders, such as Flozell Daniels, Jr., president and CEO of Foundation for Louisiana (FFL), are also redefining the conversation about what a foundation can and should do with its resources. His team’s mission investing projects are emblematic of the growing movement of foundation leaders committed to mission investing. Here is our conversation.

Flozell, how does your foundation define mission investing?

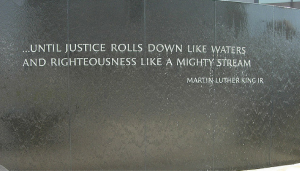

FFL has a six-year history of using Program-Related Investments (PRIs)[1] as a strategic tool to realize socioeconomic equity. This approach is primarily informed by our mission to “invest in people and practices that work to reduce vulnerability and build stronger, more sustainable communities statewide.” Importantly, our fund is a source of community development financing for transformative projects that may not have initial access to capital. Our investments are typically paired with grant products that facilitate capital formation. This year, we’re exploring the viability of newer tools, such as Social Innovation Bonds, to stoke social change and more effective use of both private and public resources. We push the envelope to use every available tool to reduce historic disparities in race and geography, while investing in the amazing talents of Louisiana’s people.

Your foundation is focused on PRIs. Can you share an example illustrating your PRI work?

One of our recent community investments, Jack & Jake’s Public Market, supports bringing healthy food access and job opportunities to New Orleans’ Central City neighborhood. It will be located in a re-purposed historic former school building, on a historic main commercial thoroughfare experiencing new vibrancy after decades of disinvestment. We invested $300,000 to support build-out and initial operation.

We’re especially proud of the multiple benefits Jack & Jake’s will provide. First and foremost, the market will offer regionally-sourced, fresh and affordable food to a neighborhood long lacking in easy access to fresh foods. Further, the new market will create an estimated 30-plus new full-time jobs and 30-plus part-time jobs, and help to sustain regional farmers and fishers.

Beyond these benefits, the building’s revitalization will contribute to catalytic neighborhood change. This is FFL’s third commercial, public-purpose investment in the Central City neighborhood. Right now, Jack & Jake’s is just one of several major renovation projects underway in a few-block stretch.

What was the biggest challenge or obstacle you faced when getting started? And how did you overcome it?

We were founded in 2005, soon after Hurricanes Katrina and Rita, and moved into PRIs about three years later. In 2008, our state was collectively turning the corner from crisis mode to the longer-term work of addressing decades of inequity, much of which was exposed with new starkness by the 2005 disasters.

Our board, full of philanthropy and social investment veterans, understood the critical role of mission investing and PRIs in economic equity and community resilience. FFL was fortunate to enlist Urban Advisors, LLC, an expert community development finance consultancy that helped develop our strategy and operating model for our PRI Fund. With initial support from the W.K. Kellogg Foundation and Ben & Jerry’s Foundation, we implemented the model and made successful initial investments. The Bush-Clinton Katrina Fund, The F.B. Heron Foundation, JPMorgan Chase Foundation, The Kresge Foundation and the Mary Reynolds Babcock Foundation also provided critical resources to help us build the fund’s infrastructure. For board members who were concerned about the shift in overall practice and diversion of resources, having expert assistance on the front end made a critical difference.

What advice would you give to foundation peers interested in partnering with FFL or starting mission investing themselves?

Now is the time! More than ever, the sector must find more responsive uses of precious resources. Creative, accessible and well-designed lending products remain critical to affordable housing, job creation, healthy food access, nonprofit stabilization, as well as newer areas such as criminal justice reform, creative economy and environmental resilience. FFL’s PRI Fund is evolving into a Community Investment Loan Fund designed to attract investors seeking high-impact social investments that stoke socioeconomic opportunity and realize risk-mitigated returns.

FFL is the only philanthropic solution partner in Louisiana with extensive experience in community investment lending. As such, we welcome new partnerships. We’re certain that foundations looking to diversify their investment portfolio and expand the success of their programmatic investments should strongly consider embracing mission investment, and hope to expand the ranks of funders across the American South that employ it. With Mission Investors Exchange and the growing body of our peers with direct experience, it’s easier than ever to bring the full weight of our collective resources to the fore in creating lasting solutions.

For more, join Flozell Daniels, Jr. and Aaron Dorfman, executive director of the National Committee for Responsive Philanthropy, for their mission investing workshop at the Southeastern Council on Foundations Conference November 12-14 in New Orleans, LA.

1. According to Mission Investors Exchange, PRIs are “below-market mission investments … made to achieve specific program or mission objectives.” More here.

Christine Reeves is senior field associate at the National Committee for Responsive Philanthropy (NCRP). Follow @NCRP on Twitter.

Leave a Reply