Editor’s note: This post first appeared on the Alan Cantor Consulting blog.

Arthur Schopenhauer said, “All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident.”

I’m no expert on German philosophers, but Schopenhauer really nails it. Just think of the cause of marriage equality, which has followed exactly that course, passing from ridicule to violent opposition to acceptance as self-evident over the course of the last 20 years.

The effort to reform donor-advised funds (DAFs) does not have nearly the societal ramifications of the marriage equality issue. That said, donor-advised fund reform is an enormously important issue for American philanthropy, and when viewed through a Schopenhauerian lens, the effort has recently transitioned into the second phase of truth: violent opposition.

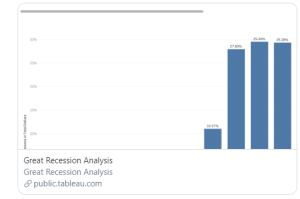

A little background: Donor-advised funds have seen tremendous growth in recent years, with donations to DAFs rising 105 percent over the last four years. DAFs are a you-can-have-your-cake-and-eat-it-too philanthropic vehicle. Donors get a full charitable deduction when they make a donation to their fund, but they retain the right to say how the funds should be distributed to charitable causes in the years that follow. But no money needs to go out the door to actual operating charities in the year of the gift or ever. Instead, the funds can remain invested in accounts at the sponsoring organizations, which range from community foundations to religious federations to, most recently, entities created by Fidelity, Schwab, Vanguard and other financial services firms.

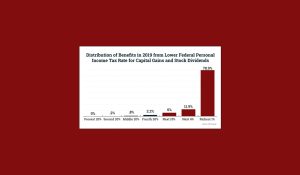

Why is this a problem? Well, the federal government subsidizes donations to nonprofits through the charitable income tax deduction. The notion behind the charitable deduction is that these donations are for the public good. It’s easy to understand how a gift to a food pantry is for the public good. But it’s hard to understand how a gift to Fidelity Charitable is for the public good. After all, why should a donor get a charitable deduction in 2014 for money that won’t go out to charitable purposes for years – and perhaps not ever?

I can hear my friends in the donor-advised fund industry (and I do still have some, which is a tribute to their patience) howl as they read this. “But it is for charity!” they attest. To which I answer: but charitable distributions are not required. Until the money is granted from the DAF to operating charities, the funds are simply invested in the markets, making money for Wall Street and doing nothing for society.

Consequently, I support the proposal by Ray Madoff, professor at Boston College Law School, that money contributed to donor-advised funds needs to be distributed to charity within seven years. That seems like a common sense reform. People who are in a position to make a big gift in 2014 – say, if they sell a business and have lots of capital gain and tax liability – can put money in their donor-advised fund right away and then have until 2020 to get that money out to homeless shelters, youth programs, schools, museums and other charities.

When Madoff and I were two of the very few people in the country who were advocating for this required spend-down, we were gently ridiculed. “Unnecessary,” one person told me. “What exactly is the problem you’re trying to solve?” Our views were dismissed as fringe and unimportant.

Then, in the spring of this year, a man named Dave Camp publically agreed with us. In fact, he said the required pay-down should be completed in five years, not seven. And the reason his opinion matters more than those of people named Madoff or Cantor or Jones is because Dave Camp is the Chair of the House Ways and Means Committee, and the DAF spend-down proposal was folded into his extensive proposal for federal tax reform.

At that moment, reaction to the proposal shifted from ridicule to violent opposition. The spend-down notion was no longer an annoyance but a threat. My favorite over-the-top reaction was a hastily-summoned webinar by the Alliance for Charitable Reform (ACR). The speakers, all representatives of the donor-advised fund industry, shared an irate and condescending tone. In high dudgeon they emphasized the efficiency of DAFs compared to private foundations, ignoring the obvious fact that the real comparison should not be between two entities (DAFs and private foundations) that warehouse charitable dollars, but between gifts to donor-advised funds and outright gifts to operating charitable organizations. “There are not enough charitable dollars to go around!” declared Brent Christopher, CEO of the Communities Foundation of Texas, on the webinar. Christopher thought that this was an argument for letting donor-advised funds operate as they have been; to my mind the shortage of charitable dollars is a big reason for requiring DAFs to distribute money.

Rather shockingly, the ACR webinar featured Jeff Zysik, the CFO of Donors Trust, a DAF sponsor. Donors Trust gained notoriety, as I wrote in March, for effectively laundering politically-motivated charitable contributions by Charles Koch. That the Alliance for Charitable Reform chose to showcase one of the nation’s most discredited donor-advised fund mills as an exemplar of the industry demonstrates a remarkable degree of tone-deafness.

A line heard throughout this webinar and in other similar defenses of DAFs is that a requirement that the funds go out to charity within a set number of years would constitute an unwarranted and damaging governmental intrusion into charitable giving. And, at the same time, these Libertarian-flavored spokespersons insist that the charitable deduction for gifts to DAFs be left untouched. In short, government should stay out of their way – other than to continue to deliver a tax deduction to the donor. (Hypocrisy? You be the judge.)

What are the chances for common-sense, meaningful reform of donor-advised funds? That is, will DAFs ever be required to actually dispense money to charity? There are certainly obstacles. Most notably, DAFs are a cash cow for Wall Street, and we know that Wall Street, in large measure, tells Congress what to do. Very little legislation passes these days without a sign-off from the financial services industry.

But I have faith that when a growing majority of people sees the truth, the right thing happens.

Most people without a stake in the current DAF structure are frankly shocked when they learn that donor-advised funds provide donors with a full charitable deduction, but that the money can then sit there indefinitely without any required charitable distribution. And once the number of people thinking this way reaches a tipping point, Congress will finally enact a pay-out requirement for donor-advised funds. The nation will no doubt see this as an action that was overdue, logical and, of course, self-evident.

Alan Cantor spent nearly three decades in the nonprofit sector before founding Alan Cantor Consulting LLC in January 2012.