In response to the ongoing suspicious, and potentially illegal, behavior of the three trustees of Minnesota’s Otto Bremer Foundation, NCRP is now asking the IRS to investigate and take action if needed. NCRP’s executive director Aaron Dorfman sent a letter to IRS director for exempt organizations Tamera Ripperda detailing the many red flags among the trustees’ activities.

NCRP’s investigation was prompted by an incident in early June, when Otto Bremer Foundation trustees S. Brian Lipschultz, Charlotte Johnson and Daniel Reardon pushed out their executive director and named themselves co-CEOs. NCRP examined the foundation’s IRS tax records to find that this ousting was only the latest in a series of troubling decisions.

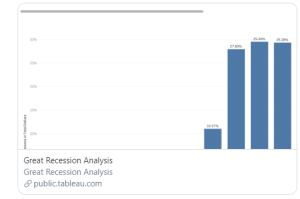

Dorfman’s letter outlines the escalating situation. The foundation’s new structure lacks accountability and fiduciary oversight, giving the three trustees complete control of the organization’s nearly $800 million in assets. Further, trustee compensation has increased by 1000 percent over the past 10 years, during much of which time the country was struggling with a recession. In 2013 alone, the trustees received more than $1.2 million from the foundation, compared to the $24,000 median trustee compensation among the country’s largest foundations.

The foundation owns 92 percent of Bremer Bank, and the trustees also receive payment for their roles with the financial institution. Further, in recent years, the foundation has significantly increased its legal fees.

These circumstances raise some difficult questions: Are these legal services to create a justification for the jump in compensation? Do these enormous salaries run afoul of IRC Chapter 42, which limits compensation within private foundations to levels that are reasonable, not excessive and comparable to the general public? Is it possible the trustees are using other foundation assets for personal enrichment?

Dorfman warns Ms. Ripperda,

“You must move aggressively if you hope to protect [the] public trust as well as the legacy of Otto Bremer, a man who established his foundation to ‘assist people in achieving full economic, civil and social participation in and for the betterment of their communities.”

Recently, NCRP also called for an investigation by the Minnesota Attorney General. Her office has yet to confirm whether she’ll be launching an investigation.

Read the full text of the letter to the IRS here.

Yna C. Moore is communications director of the National Committee for Responsive Philanthropy (NCRP). Follow NCRP on Twitter (@ncrp).